Deal has ended, view more bank account bonuses by clicking here.

Offer at a glance

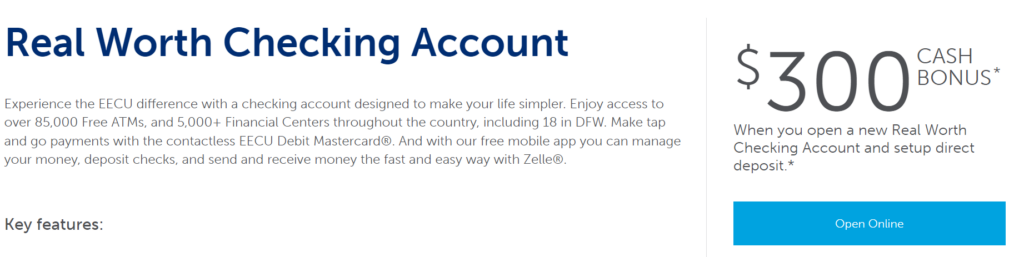

- Maximum bonus amount: $300

- Availability: TX

- Direct deposit required: Yes, $1,500+ within 90 days of account opening

- Additional requirements: None

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: No credit card funding, can fund up to $1,100 with a credit card

- Monthly fees: None

- Early account termination fee: Unknown

- Household limit: None listed

- Expiration date: None

Contents

The Offer

- EECU is offering a $300 bonus when you open a new Real Worth Checking and complete the following requirements:

- Make at least $1,500 in direct deposits within 90 days of account opening

The Fine Print

- To qualify for the $300 cash bonus, account must be set up on direct deposit with EECU and you must make at least $1,500 in direct deposits within 90 days of account opening.

- After you have completed all requirements, EECU will deposit the cash bonus into your new account within 90 days.

- Account must be open and in good standing to qualify for this offer.

- Offer is not available to anyone who has an ownership interest in (including, but not limited to, primary owner or joint owner) any existing EECU checking account or had an ownership interest in a checking account that closed within the last 12 months.

- EECU reserves the right to limit each member to one new account-related incentive per calendar year.

- Eligibility may be limited based on your account type and ownership role.

- This offer is subject to change at any time without notice.

- Offer cannot be combined with any other offer.

- The value of the cash bonus may be reported to the IRS and the recipient is responsible for any federal, state, or local taxes on these offers. EECU employees, board members, and their family members are not eligible for this offer.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Early Account Termination Fee

Our Verdict

According to this comment chain it looks like they will conditionally approve OOS and then deny at a later date. Not a bad bonus if you live in state, it might be ChexSystems sensitive as well. Share your experiences in the comments below.

Hat tip to Bockrr

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

this expired, shit offer

Who pissed in your Cheerios?

Wouldn’t you be upset if your name was “shit”?

I’m mean, I’m a shriveled little green asshole, so…

No, you’re Pickle Rick! Wubba lub dub *burp* (insert other Rick phrase here)

I opened on 11/4

I funded on 11/5 by Fidelity brokerage transfer

Still not received, should I be concerned as I don’t see anyone being paid later than 3 business days

I applied for this account back in July and was denied for Chex. A few days ago I reapplied with Chex frozen and requested $1100 funding with Citi DC card. Yesterday I received an email asking me to unfreeze, and today I was approved. I’m in North Dallas area (Addison)

That’s interesting. Do you have your Chex stats for when you applied each time?

I was denied in Jul as well, what were your Chex stats before recent approval because I believe they are bit chex sensitive?

X/1,X/3,X/6,X/12

Funding $1100 (the maximum allowed) with a US Bank Biz Leverage failed, but succeeded a Chase Sapphire Reserve

Anyone closed their account after receiving the bonus. How did you do it, phone call or secure message?

Update: I closed by sending secure message to EECU on the account.

No early termination fee?

No, they did not charge me any.

Thank you!

Don’t bother applying if you live outside of DFW. I live in Austin:

8/21: applied

Online application status says that they’ll let me know decision by mail within 30 days

9/24: still no mail, so I called and they said that it was declined because I don’t live in DFW. I asked why it wasn’t listed on the website, and they said that it’s a new rule.

soft pull? had to authorize to pull record

Applied from Houston, got through application and uploaded DL. Next day rep stated they’re only opening accounts for DFW. Burned a Chex pull, tempted to drag the whole family to Dallas to churn them for not specifying DFW on their site.

You might be wasting your time. OOF wasn’t allowed in branch when I applied in July, and I’m about 1.5 hours outside of DFW.

The site does actually specify counties surrounding DFW here, but it also claims eligibility is available through a complimentary EECU Community Foundation Membership. I was on a spree when I tried, and I forgot that it was listed as an option.

Have you tried applying online?

Nope. I’ve had some issues opening accounts online for identity verification, and EECU also seems semi-sensitive to Chex. My Chex is 3/1 7/3 11/6 23/12 right now.

I can prove my identity and talk through Chex in person, but those issues plus OOF make denial online likely. Not worth wasting a Chex pull IMO.

My p2 got approved online with a McLennan county address. I’m in DFW, but haven’t opened mine yet. I sent p2 $1,550 from Fidelity and they received the $300 bonus next day after Fidelity posted.

8/31: Applied went pending, 5 minutes later received a text to upload my DL and then received conditional approval

9/3: Received text that I will receive their decision in the mail, called in and was denied due to “not being in DFW”. In Texas, but not DFW.

Seems I passed the Chex test if helpful: 0/1, 1/2, 2/3, 3/6

Quickest bonus ever.

Successful DP here for P2 (TX resident), P1 application rejected due to chex at branch

8/24: Applied online, chex 5/24 & 4/8, conditionally approved, uploaded DL. Chex entry same day.

8/26: Called customer rep, verified myself, he approved. Added to schwab brokerage account, waiting for micro deposits.

8/27: $25 Initial deposit seen. Micro deposit credit transactions seen, micro debit didn’t work since account is still new & under freeze

8/28: initiated $1502 push from schwab account

8/30: schwab push completed. $300 bonus credit with comment “Deposit CHECKING BONUS”

8/30: Addition of EECU account to SoFi worked after 4 days. Pull transfer initiatied from SoFi. Same day debit from EECU, funds on-hold at SoFi.

Are you in the DFW area? TX resident here, but ~200mi from DFW, not sure if I’ll get approved

I am in San Antonio and got denied