Deal has ended, view more bank account bonuses by clicking here

This was formally called JSC Federal Credit Union

Offer at a glance

- Maximum bonus amount: $100

- Availability: TX, might be able to qualify through ACC

- Direct deposit required: Yes, $300+

- Additional requirements:

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Yes, $5,000

- Monthly fees: None

- Early account termination fee: Unknown

- Household limit: None listed

- Expiration date: December 31, 2024

Contents

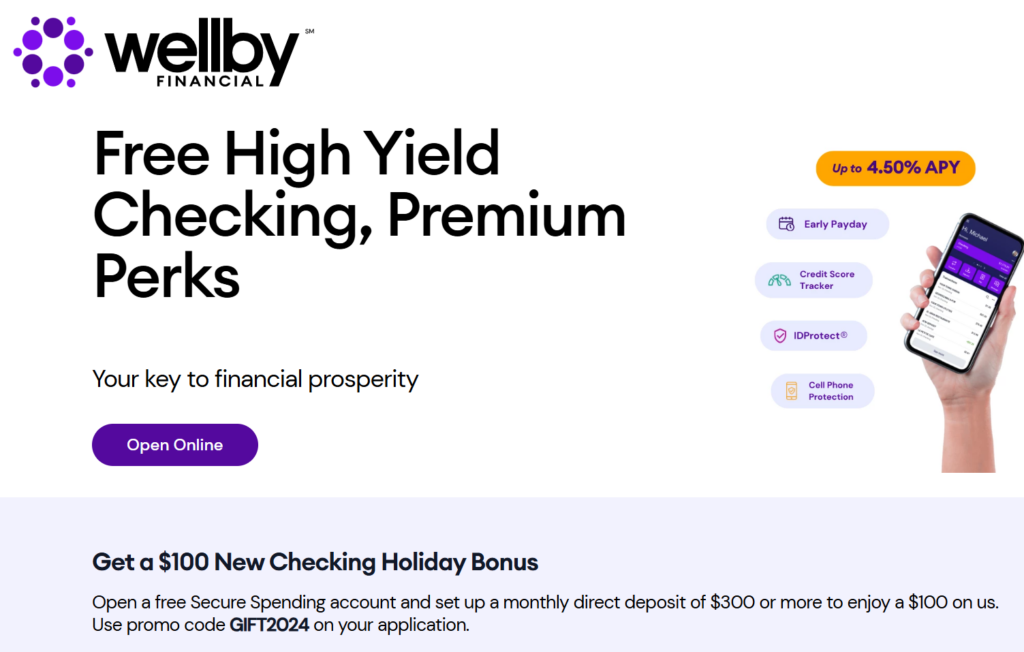

The Offer

- Wellby Financial is offering a $100 bonus when you open a new checking account and complete the following requirements:

- Use promo code GIFT2024

- Set up a monthly direct deposit of $300+

The Fine Print

- November 12 – December 31, 2024.

- To be eligible, you cannot have any existing Wellby checking accounts.

- To receive the bonus of $100.00, you must open a Wellby Secure Spending (checking) account either online or in a branch using the promo code: GIFT2024 during the promotional period and set up a direct deposit equal to at least $300.00 per month within 60 days of account opening

- . Your bonus will be credited to your new checking account within 14 days following confirmation that you completed all the offer requirements and meet the qualifications. Membership and registration/activation required. Restrictions apply.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

This account has no monthly fees to worry about.

Early Account Termination Fee

Unsure if there is any EATF.

Our Verdict

Hopefully opening out of state works, very good bonus with this amount of credit card funding.

Hat tip to Jimmy Johns

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

What is the max CC funding that they allow?

They pull Chex for every additional account.

12/13 Account opened. Funded with USB Triple Cash.

1/9 $350 Novo DD (Details say “CLASS CODE:PPD”)

1/23 $100 bonus posted.

I wanted to add that I had Chex frozen when applying. They made me unfreeze but they don’t seem to be sensitive. They would ask you questions like “Why so many inquiries ?” or “What products were you looking for?” over the phone mostly so they can direct you to their own products with equivalent or better offerings. I made up reasons like “I’m shopping around for CDs due to high interest rates.” and they were okay with that. Very chill bank and bonus imo.

I created another account to take advantage of CC funding. They pull Chex and make you do the entire application process again. They’re still easy going but I don’t like being asked all the questions all over again when I’m an existing customer.

12/31/ opened account

1/7 Wise DD 300.87

1/7 withdrew 300.87

1/21 bonus paid 100 listed as “DEPOSIT DIRECT DEPOSIT PROMOTION”

Ensure to turn on eStatements

“we’re introducing a Debit Card Loan Payment Fee and a Paper Statement Fee starting March 1, 2025”

12/04 opened

12/31 real dd

01/14 bonus paid

DP- Ally works

12/15 Opened

12/30 Ally push posted

1/13 bonus paid

11/18 Opened

Real DDs with work

12/31 bonus paid

Account opened 12/1, DD posted 12/16, bonus paid 12/30