U.S. Bank has just launched a new premium card, this time a co-branded card with Korean Air SKYPASS. Let’s take a look at the new card.

Contents

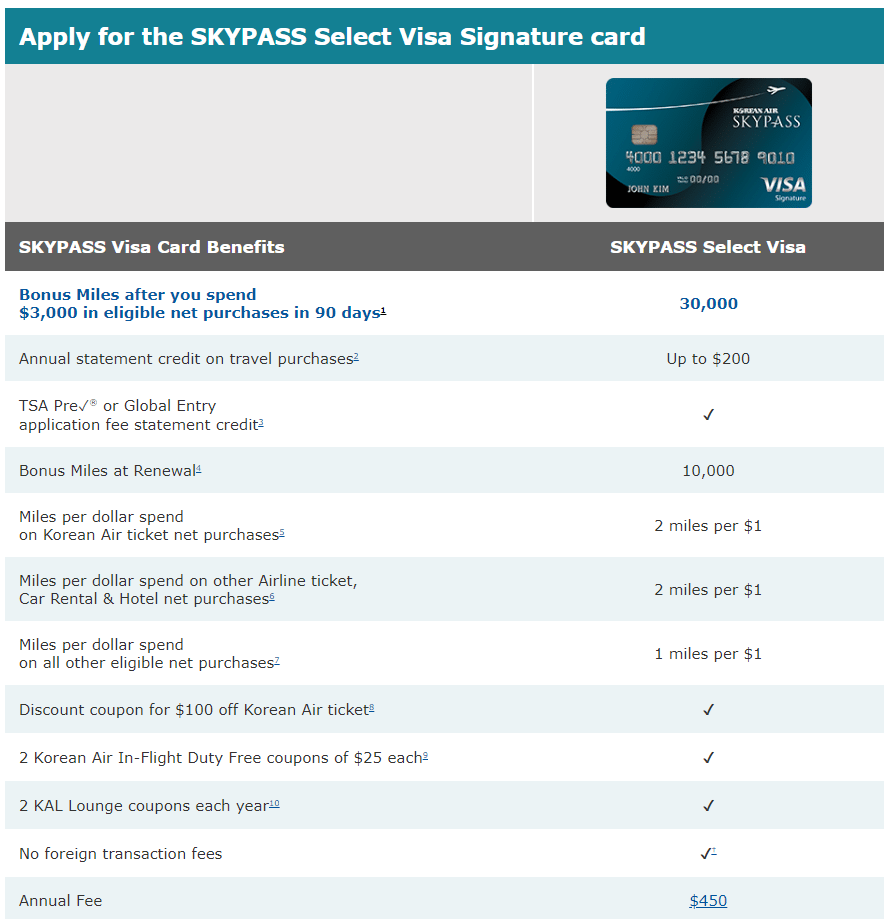

Card Basics

- Annual fee of $450, not waived fist year

- Sign up bonus of 30,000 miles after $3,000 in spend within the first 90 days of card opening

- $200 annual statement credit on travel purchases (this is based on a card member year, not calendar)

- TSA PreCheck/Global Entry Credit of up to $100

- 10,000 bonus miles on card anniversary, must spend $35,000 in the prior year

- Card earns at the following rates;

- 2x miles per $1 spent on Korean air purchases

- 2x miles per $1 spent on Airline ticket, Car Rental & Hotel purchases

- 1x mile per $1 spent on all other purchases

- Discount coupon for $100 off Korean Air ticket

- 2 Korean Air In-Flight Duty Free coupons of $25 each

- 2 KAL Lounge coupons each year

Our Verdict

In July last year they sent out a survey regarding this possible card, so it’s interesting to see it finally launch with a lot of the benefits they surveyed people on. Personally I think this card sucks, you’re paying an annual fee of $450 and the benefits are lackluster. Most people already have TSA PreCheck/Global Entry, the renewal miles required $35,000 in spend to receive, the earning rates suck and one time discounts on airfare and in-flight duty fee don’t make up for the fact that the card has no other redeeming benefits apart from the $200 travel credit that is based on a card member year. Maybe if the bonus was better I could see this being useful for some people but even on the existing U.S. Bank Korean cards we’ve seen better bonuses in the past. It seems like U.S. Bank are hoping to cash in on the success of the Altitude card, but without offering any similar benefits.

Hat tip to Chong786

>2x miles per $1 spent on Korean air purchases

2x miles per $1 spent on Airline ticket, Car Rental & Hotel purchases

There’s some redundancy there haha

Keep in mind the 2x on korean air would include other things such as in flight purchases, not just tickets

This card for sure will be one of the most garbage cards besides Chase Starbucks in this year…… lmfao

if they changed the $200/year travel credit and $100 KE credit to a $300-350/year KE credit, I might be interested.. but the signup bonus has to exceed their targeted personal/business 40k/45k/50k offers.

$35000 = lol

“personally I think this card sucks” Lol

The bonus is lower than my $95 fee card lol. I got 40K bonus last year.

I just got a $95 BoA card with a 50K bonus, TSA PreCheck/Global Entry Credit, $100 incidental travel credit, and no PP access. Not sure why I’d pay an extra $350 for and extra $100 total in travel credits and not much else.

What is wrong with this board?

This is like US Bank’s version of the Starbucks cc except for SKYPASS.

Another copycat product with no innovative features whatsoever.

Crappy card. And even then, half the battle will be finding an actual flight with Korean Air.

If their goal is to capitalize on a lot of frequent KAL customers that fly back and forth to Korea a lot and have a high net income, they may well succeed there. If their goal was to get lots and lots of churners to sign up for the card bonus and then dump it after the first year — or use it for lots of manufactured spending — then they have certainly failed miserably. Let me guess which one might be more profitable for them & KAL… Hmmm…

Your first scenario obviously includes the condition that the customers are blacklisted from Chase for some unknown reason.

You’re assuming the folks they want to target have any interest in messing with a currency that needs to be transferred or redeemed on a specific travel site. If they just want to add to their KAL mileage account, then this is an easier solution. There are a lot of folks that have no interest in messing with transferable currencies.

This is actually bad even for people who travel between korea a lot. CSR is superior in every way seeing as you can transfer and earns more even on KAL purchases. Whoever made this card is catering to people who aren’t even aware of other options.

Again, if they are targeting KAL customers and passengers, then this might well appeal to that segment. There are lots that prefer to not deal with the hassles and rules of transferring currency. This is clearly designed for folks that already value KAL. There are dozens of profitable segments in the banking/cc industry. If they can tap into a segment that doesn’t care about more generic options, this is easy pickins for them. The real argument would be — is there enough upside within the segment to get people to choose this over the standard product.

A fool and his money are soon departed. You really think that people want Korean air miles that bad that they’d just hand over $450 because they don’t want the hassle of using transferable currency? Really? They already have several Korean Air credit cards for that with AF of $80, $50 & $0.

For $450 they are clearly looking for something else. This is clearly a luxury card with very little benefits. Maybe if they offered Korean air lounges and priority pass lounges that might lead to more Korean air miles seeking passengers. This card is a dud.

I’m completely surprised they didn’t. Maybe they see Citi and Chase cutting benefits and think that’s their OK to slack off?

If you want Korean miles, just use a CSR.