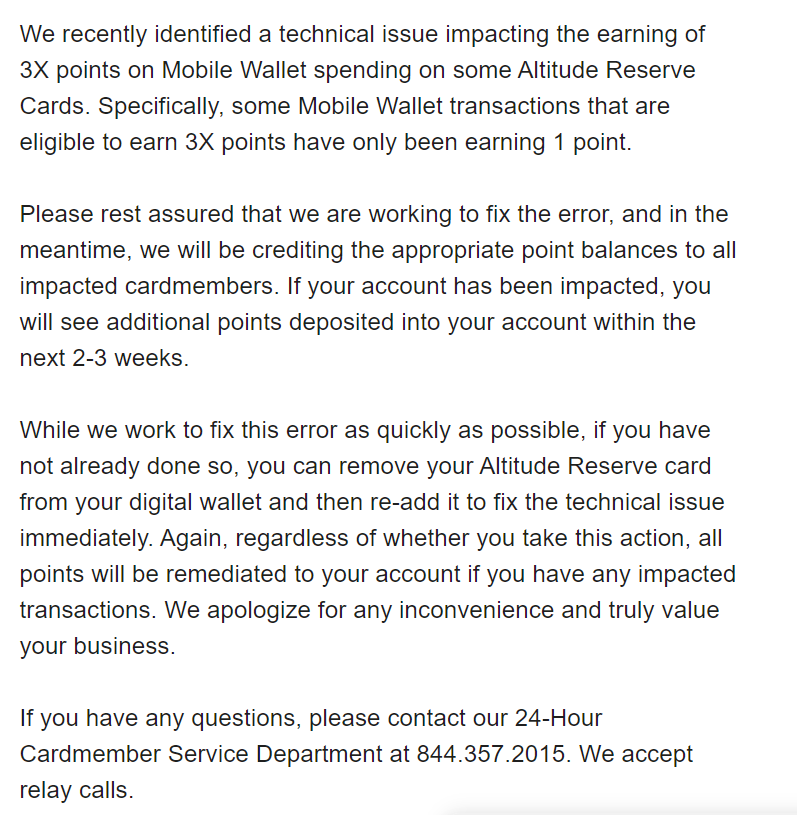

At the start of April we linked to a report that the U.S. Bank Altitude Reserve card was having issues with mobile transactions not earning 3x points. U.S. Bank has reached out to cardholders stating that they are working to fix the error. It looks like you can immediately fix the error by removing your card and readding it.