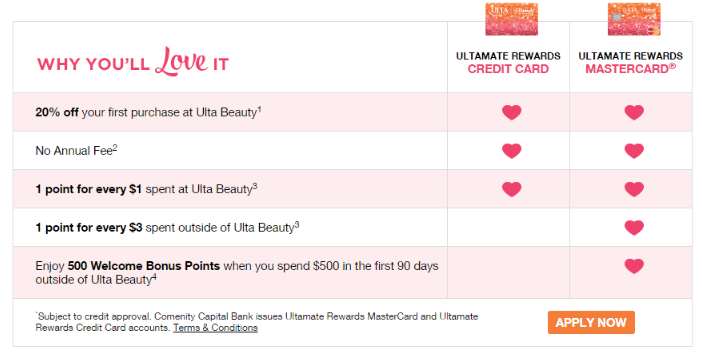

Ulta recently partnered with Comenity Bank to introduce two new cards: Ultamate rewards credit card & Ultamate Rewards Mastercard. The credit card can only be used in store at Ulta (really should be called a store card) and the Mastercard can be used anywhere Mastercard is accepted. Both cards come with the following features:

- 20% off your first purchase

- No annual fee

- 1x point for every $1 spent at Ulta beauty

The Mastercard also comes with 1x point for every $3 spent at outside Ulta beauty and a welcome bonus of 500 Welcome points when you spend $500 or more within the first 90 days outside of Ulta Beauty.

How Much Are Points Worth?

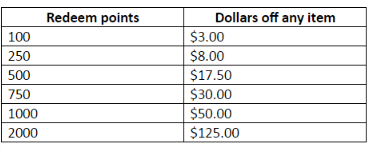

That depends on how many points you have, here is the ‘award chart’:

At most your points will be worth 6.25¢ each. Points also expire one year after they are earned unless you have Platinum status (requires spending of $450 or more in a calendar year).

Our Verdict

I don’t think the shopping cart trick works for this card (apparently it might work for at least the store card), this card is actually pretty good for purchases at Ulta with a maximum of 6.25% back and minimum of 3% back. For all other purchases, you’d be better offer using one of the cards that earn 2%+ cash back on all purchases.

The statement was sent to the old address, so I had forgotten the cutoff time since I did not receive the bill. They never accepted that it was not my fault the statement was sent to the old address and refused to reverse the late fee. Please note, the cut off time was missed by half an hour not even an hour. This was not fair, and I would not do business with them anymore.

Don’t get it!

They do not have a grace period. I always sent my payment 10 days or more before due but for some reason is always listed one or two days after the due date. They then charge you a finance fee, late fee and a late charge.

Even though I have an excellent credit rating because I am a good borrower they have chose to treat me like a piece of shit.

I WIIL NEVER USE THEIR CARD!

Warning!!!!Thinking it was a rewards card. I was tricked into get a credit card. The moment I found out about it… I canceled a week after. Thinking that the sales rep used my debit card. Two months had passed by and I was charged $44 instead of the previous original price I was charged with product for $21.50. Talking with customer care didn’t work with me on the fact I would only pay the $21.50 not the $ 44. I don’t appreciate the mind tricks that this credit card has to offer. They still want me to pay the $44s I still insist on paying it. Anyone who signs up for the reward beware of it being a credit card not a rewards card where they add points for free on your account!!! Everyone who wrote poor review on this credit card is 100% right about it. They are money hungry for the wrong reasons. And there is no reasoning with them about it… just sayin…😠😡😠😡

As I found out today it is one application for either card. You only find out when you receive the card. Received an email I was approved for the MasterCard received the rewards card. They could not give me a reasonable explanation. I tore up the rewards card and now my credit took the application points hit. Ulta is who is suffering for this because they are losing customers. I have read more bad reviews on this bank than good.

I signed up for the rewards card and was supposed to be given a 20% off cupón and never got it!!! I signed up online and received my card, no coupon??? When do they give it to you?!

Don’t apply foe ulta card they will close account even if you pay ontime

The interest rate is very high. It is usually a poor decision by a poor person to use this kind of card. I cancelled mine

I applied for Ulta and it says will be notified within 10 days .. I most likely know it’s a deniel.. yet I have Victoria secret,newyork&co,simplybe,and just got approved for express this week.. I really wanted Ulta but I will have to wait a few months .

I have all those cards too and a credit one platinum and they still wont approve me. But yet they preapproved my friend whos credit score wasnt even a 500. This store credit card makes no sense. Btw she used the card and never paid them back. I pay all my credit cards the day the bill is put out. But still no preapproval or approval.

What is the minimum payment you have to pay when your bill is due??

Aneette, I don’t know with this card specifically. You can read this post for general info on that question https://www.nerdwallet.com/blog/credit-cards/credit-card-issuer-minimum-payment/

How do you do the shopping cart trick?

Read this post: https://www.doctorofcredit.com/shopping-cart-trick-get-credit-cards-without-the-hard-pull/

This doesn’t actually work even following the directions it still results in a hard pull I was just able to get pre approval doing this but once I accepted I got a hard pull with 2 bureaus

Did you have to enter your full SSN?

i just apply and approved,only ask last four of SSN, still hard pull.