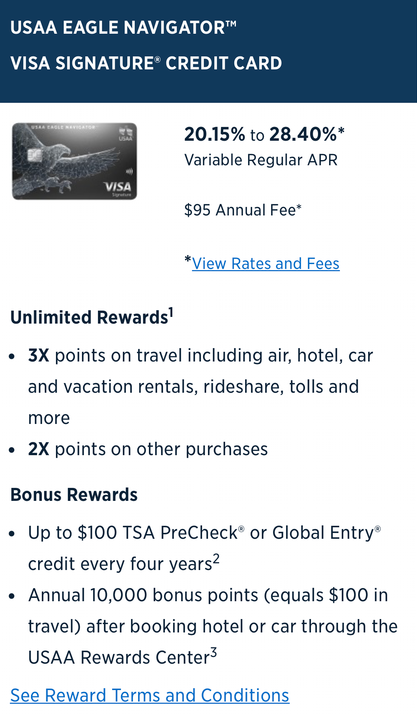

USAA has launched a new credit card called ‘Eagle Navigator’, card isn’t listed on the credit card page but is being offered to existing users. Card basics are as follows:

- $95 annual fee

- Card earns at the following rates:

- 3x points on travel

- 2x points on all other purchases

- 10,000 annual bonus points after booking hotel or car travel through the USAA booking portal

- $100 TSA PreCheck/ Global Entry Credit

Given that a lot of cards earn at 2%+ and don’t have an annual fee I don’t really see this card of being any use. Dead on arrival unless they add more benefits/more lucrative earning categories or a large sign up bonus.