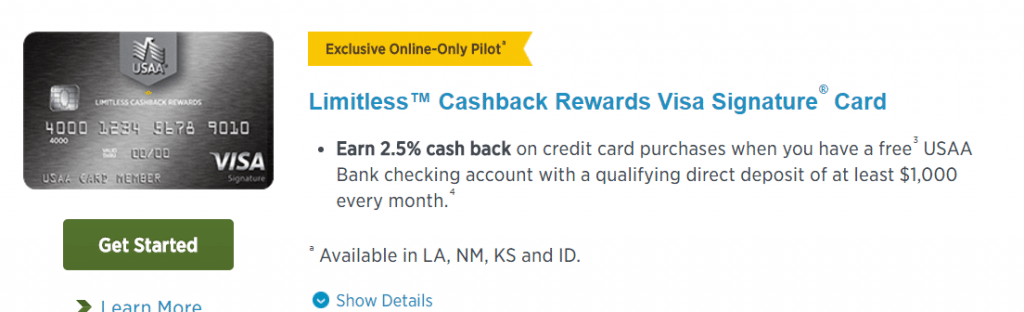

At the start of October USAA launched a new credit card called ‘Limitless’, you can read our full review here but the main thing to know is that it earns 2.5% cash back on all purchases (as long as you have a USAA checking account that receives a direct deposit) with no annual fee. Previously it was only available on an invite only basis, but now anybody in the following states can sign up: LA, NM, KS and ID. You can use this link and the offer will show if you select any of those four states as your location.

As mentioned before you can read our full review of the card here. This includes the eligibility requirements for USAA, credit limits people have reported receiving and other information. We’ve also added this card to our list of the best credit cards for all purchases.

Hat tip to reader Rice

Never been happier to be a resident of Kansas =)

Well, that sucks. I was denied because “Maximum credit extended” =\ I have two cards with them currently and fairly large credit limits (higher than most of my other cards). Messaged to see what I can do about that…

Hopefully they’ll allow you to reallocate credit.

The message I received basically said “reduce your credit limit on another card, but that won’t guarantee anything.”

So I did, lowering my limit on one card by $8K, and asked the lady I talked to whether I should wait or if the change would be reflected if I applied again. She said the change was immediate, but did not inspire confidence about whether the credit check would be change.

And…”Maximum credit extended”

Additionally, I told her that with other banks I have been initially denied, but called in and they just removed credit from another card to apply to the new card. She said she didn’t know anything about that. But at this point I am considering closing some of my several loopholed AAdvantage cards to free up more credit.

She’s probably just saying maximum credit extended with USAA, so I don’t think closing AAdvantage cards will help. I’d hang up and call again and offer to reallocate or reduce credit lines with USAA.

I got the same denial reason! I called and he said “call Equifax to see why” and said it could be my total credit on ALL my cards…. But this has never been an issue for me before. I have two USAA cards as well, but they only equal $16k combined and that’s hardly anything. I’m going to call them back on Monday to see what I can do cause that vague response is kind of annoying. :/