Update 2/26/25: Extended to April 8, 2025

Offer has been extended to 4/8/25

Offer has been extended to 2/25/25

Update 11/13/24: Extended to January 7, 2025

Offer extended to 11/12/24

Update 8/21/24: Extended until October 1, 2024

Update 7/10/24: Extended until August 20, 2024

Update 5/22/24: Extended until July 9, 2024.

Update 4/10/24: Extended through 5/21/24

Offer at a glance

- Maximum bonus amount: $325

- Availability: Nationwide

- Direct deposit required: Yes, $1,000+

- Additional requirements: None

- Hard/soft pull: Soft

- ChexSystems: Mixed reports, likely doesn’t pull

- Credit card funding: None

- Monthly fees: $10, avoidable

- Early account termination fee: None, don’t close account straight away please

- Household limit: None

- Expiration date:

January 6, 2023February 27, 2023 April 10, 2023 August 21, 2023October 10, 2023April 9, 2024May 21, 2024

Contents

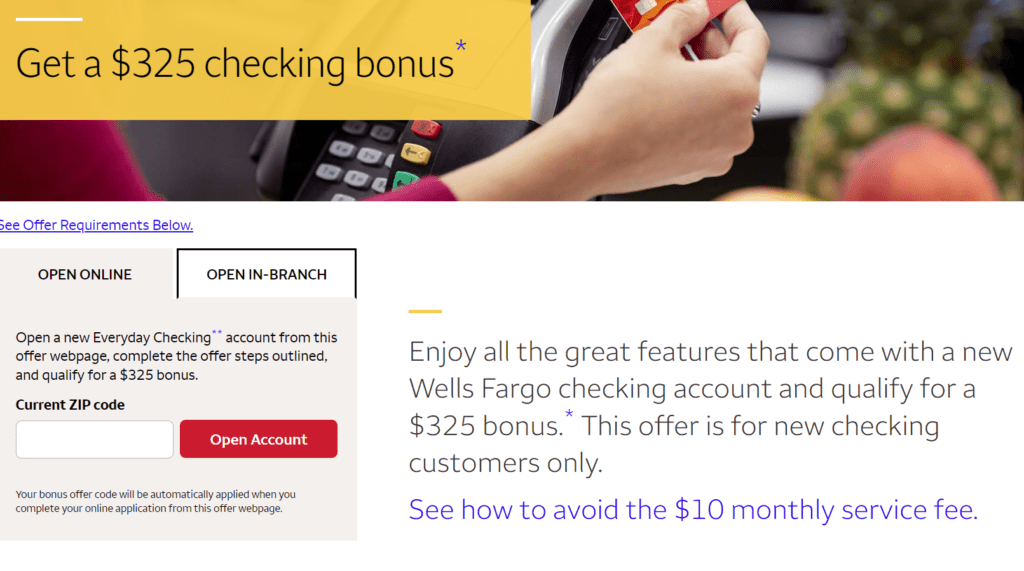

The Offer

- Wells Fargo is offering a $325 bonus when you open a new Everyday Checking account and complete the following requirements:

- Receive a total of $1,000 or more in qualifying direct deposits to the new checking account within 90 calendar days from account opening (the qualification period)

The Fine Print

Eligibility Requirements:

- This offer is for new checking customers only. All Wells Fargo consumer checking accounts are eligible for this offer with the exception of checking accounts offered by Wells Fargo Private Bank.

- You must use your bonus offer code at account opening when you apply for a new eligible Wells Fargo checking account.

- You are not eligible for this offer if:

- You are a current owner of a Wells Fargo consumer checking account

- You have received a bonus for opening a Wells Fargo consumer checking account within the past 12 months

- You are a Wells Fargo employee

Bonus Requirements:

- Open a new Wells Fargo consumer checking account with a minimum opening deposit of $25 by January 6, 2023. All account applications are subject to approval.

- Within 90 calendar days of account opening (the “qualification period”), receive a total of $1,000 or more in qualifying direct deposits to your new checking account.

- A qualifying direct deposit is an ACH (Automated Clearing House) automatic electronic deposit of your salary, pension, Social Security, or other regular income into your bank account. Confirm with your employer or the agency or company making these payments that they use the ACH network.

- Transfers from one account to another, mobile deposits, or deposits made at a branch, or ATM don’t qualify as a direct deposit.

- A direct deposit made available early with Early Pay Day does not count toward the bonus requirements until it posts to your account and is no longer pending (e.g. the pay date scheduled by your payor).

Bonus Payment:

- Once the 90-day qualification period has elapsed, we will determine if you have met the offer requirements, and will deposit any earned bonus into your new checking account within 30 days.

- The new checking account must remain open throughout the 90-day qualification period and at the time we attempt to deposit any earned bonus payment. Please note that an account with a zero balance may be closed by us without prior notice, as further described in the Deposit Account Agreement.

- You are responsible for any federal, state, or local taxes due on the bonus and we will report as income to the tax authorities if required by applicable law. Consult your tax advisor.

Additional Terms and Conditions:

- Offer expires January 6, 2023. However, offer may be discontinued or changed at any time prior to the expiration date without notice.

- Offer cannot be:

- Paid without a valid U.S. Taxpayer Identification Number (Form W-9 for U.S. persons including a resident alien). Non-resident aliens, signing Form W-8 are not eligible for the offer.

- Combined with any other consumer deposit offer (limit one bonus per customer/account).

- Reproduced, purchased, sold, transferred, or traded.

- The actions required to earn this bonus are separate and distinct from the options available to you to avoid any applicable monthly service fee for the checking account you opened.Talk with a banker or see the “Consumer Account Fee and Information Schedule and Deposit Account Agreement” for complete checking account details, including the applicable monthly service fee and options to avoid it.

Avoiding Fees

Monthly Fees

The Everyday Checking account comes with a $10 monthly fee. Get the fee waived with one of the following:

- $500 minimum daily balance

- $500 or more in total qualifying electronic deposits1

- Primary account owner is 17-24 years old2

- A linked Wells Fargo Campus ATM Card or Campus Debit Card3

- A qualifying monthly non-civilian military direct deposit with the Wells Fargo Worldwide Military Banking program4

If you have a Wells mortgage, you might be able to get a higher-level account with no fees.

Early Account Termination Fee

There is no early account termination fee.

Our Verdict

This isn’t as good as the $400 bonus we last saw in 2020, but it is better than the $300 bonuses we have recently seen. I don’t think that $400 bonus will come back any time soon, but some might prefer to wait for it. I will add this to our best bank account bonuses.

Hat tip to reader Paul K

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post History:

- Update 2/26/24: Extended through 4/9/24 (ht Jeremy)

- Update 1/17/24: Extended until February 23, 2024.

- Update 11/14/23: Extended until January 16, 2024.

- Update 10/11/23: Extended until November 13, 2023.

- Update 8/22/23: Extended through October 10th

- Update 7/5/23: Offer is back through August 21, 2023; Update 5/23/23: Extended through July 3, 2023. Update 4/11/23: Extended through May 22, 2023. Update 2/28/23: Deal is back/extended through 4/10/23 (ht 14lopeza and Dan) Update 2/27/23: Today is the final day for the $325 deal. There’s a new $300 link valid through March 28, 2023. (ht ReedMuller) Update 1/17/23: Deal is back and valid until February 27, 2023.

Current CC accounts holder. Declined when I applied using link I received in the mail with bonus code. Applied without signing on to my existing WF account.

Immediately used DOC link in another browser and applied with Sign On. Approved instantly.

successful DP

12/17 acct opened

1/3 work DD $1,001 posted

1/3 transfer out $1,000.99 to SoFi

Left a cent in the account and got a fee waiver b/c of my age. super easy $325!

Good evening. I completed the required $3k DD requirement for Offer code: DYHH0H….

Now I need the money to fulfill another bank bonus.

How much is the minimum amount that I should leave in WF so that I do not jeopardize getting my $400 bonus? Newbie here… eek. Thanks!

At least the monthly fee, plus a dollar or so, so your account doesn’t accidentally get zeroed out.

My WF “everyday checking” account requires 500 min to avoid monthly fee.IMO don’t do another bonus yet if it means paying a monthly fee!

You can also have a $500+ QDD post to your account each statement to avoid the monthly fee.

Does the one year timer start after payout or after account closure?

Bonus payout.

Last bonus received 2/15/2024 so I should be good to churn this one right?

Yes, as long as you have no WF Checking account currently open.

Same thing as guy below me, got bonus within last year.

if anyone wants it , i got this mailer in mail promo code DVBXA6

open by 14 April 2025

400 bonus

3k dds within 90 days opening

Please comment if used, don’t be a dick.

You should have asked to be contacted and not posted this publicly. Why? Because unfortunately people are dicks. But upon looking down the thread I do see someone commented on the other one that was posted. Maybe people aren’t such dicks 🙂

Thank you! Used today in person at a branch. Banker said I was eligible so I’m assuming it went through. He wasn’t able to tell me any details due to it being a mailer promo. Thanks again!

Glad I could make someone’s day!

Happy churning 🙂

if anyone wants it , i got this mailer in mail promo code CCK9K5

can’t use it as had account within last 12 months

open by 14 April 2025

400 bonus

3k dds within 90 days opening

My P2 used it. Will be interesting if it pays out though. Thank you! Orin

Orin

Just got that same one in the mail Today. 1 year churn is up march 19th.

I got one in the mail too, was wondering if both me and the wife can use it. I didn’t see anything about it being single use only. any DPs on this?

“Offer cannot be reproduced, purchased, sold, transferred, or traded.” is in the fine print.

Hence why I said it will be interesting if it will pay out. Unknown if anyone other than my P2 used it. Jon

Jon  CostcoCorgi

CostcoCorgi

Well the coupon isn’t addressed to anyone specifically, its not even tied to a specific address since it came in a mass marketing coupon packet. Will probably end up asking a banker if both me and my wife are eligible and try to get something in writing if they answer affirmatively.

I’d be less worried about it being tied to a specific address and instead being single use. I know when people have asked bankers before about mailed codes, myself included, they have said they are single use, but… sadly, bankers often give bad info because they don’t know how the system works. You don’t ask a car salesman about proper car maintenance, right? So, until the $400 is in the account, it’s questionable. Obviously I believed it would work, but I could be very sad in about 3-4 months.

Was your code the same as the code on my mailer? My mailer was part of a big package of coupons that get sent to me every couple of months. I think it is called Valpak. If your code was same as mine then it’s safe to say anyone can use it as much as they want

I guarantee numerous codes are going out. Not sure if they can be reused though. Orin

Orin

https://www.quora.com/How-many-combinations-of-six-letters-in-a-26-letter-alphabet#:~:text=%E2%80%9CCombinations%E2%80%9D%20by%20definition%20means%20without,the%20answer%20the%20teacher%20wants.

So, there are over 300 million different combinations. The US population is over 300 million.

Do you know if that’s a unique code or can it be used multiple times?

Single use. I tried using the same one for p1 and p2 and it did not work the second time.

12/6-accoutn opening

12/31 – $1000 work real DD

3/11 $325 posted

12/8/24 account opened

12/10/24 $1000 from BoA

3/13/25 $325 bonus posted

Opened 12/04/2024

$1025 push from Fidelity 12/05/2024

$325 Bonus received 03/07/2025

What is a “push from Fidelity”? Is this just a normal transfer of money from a Fidelity account?

Yes, it’s an ACH transfer from Fidelity to WF initiated on Fidelity’s site.

Specifically, Fidelity calls it an EFT. Spar

Spar

Look for Transfer > EFT to or from a bank. Link Wells Fargo and then do the transfer using your Fidelity access.

It’s a good practice to wait a week before trying to link the accounts for a smoother experience. Trial deposits, or Finicity linking, does not matter.

Thank you! I did the ETF from Fidelity. Let’s see in three month!

Hey, I tried using this Fidelity method for Citibank I believe, and it didnt count as an ACH…. initiated from Fidelity side (money mgmt). Does this sound like a Citibank thing, where Fidelity should work as an ACH with most bonuses?

Fidelity transfer will work. Doesn’t really matter what Citi shows in online banking. As long as your transfer took 1-3 days, it was an ACH. Bonus Addict

Bonus Addict