Update 4/6/20: Rate reduced to 3%

Offer at a glance

- Interest Rate: 3% APY

- Minimum Balance: None

- Maximum Balance: $15,000

- Availability: Must open in branch, all branches are in WY [Branch locator]. Non residents can open via phone (Call 307-638-4200, choose option 5, then option 5 again to get a real person)

- Direct deposit required: None

- Additional requirements: See below

- Hard/soft pull: Hard pull

- ChexSystems: Yes

- Credit card funding: None

- Monthly fees: None

- Insured: NCUA

The Offer

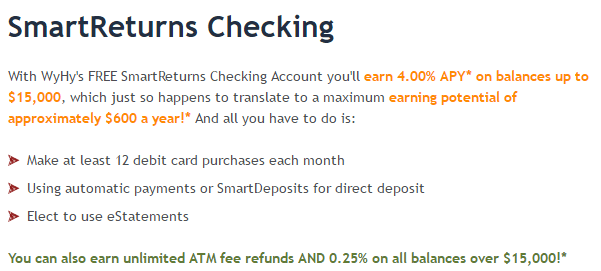

- WyHy Federal Credit Union is offering a 4% APY rate on the Free SmartReturns Checking account on balances up to $15,000 when you complete the following requirements:

- Make at least 12 debit card purchase per month [Read: How To Meet Minimum Debit & Credit Transaction Requirements]

- Using automatic payments or SmartDeposits for direct deposit

- Elect to use eStatements

- Balances over $15,000 earn 0.25% APY and you can earn free unlimited ATM refunds by meeting the above requirements)

The Fine Print

- Minimum opening deposit of $25

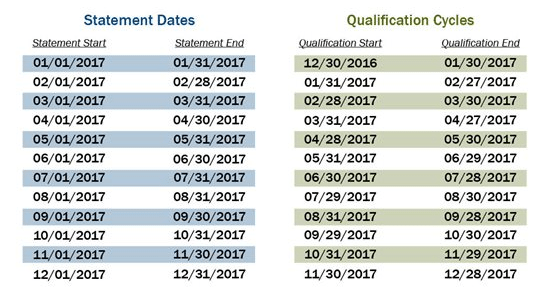

- Each qualifying period will begin one business day prior to the first day of the current statement cycle through the last day prior to the last business day of the current statement cycle.

- If you do not meet the qualifications for a qualification cycle your APY will be 0.05% for that period.

- You will not be reimbursed for any accrued but unreimbursed ATM fees at the time You close Your account.

Avoiding Fees

This account has no monthly fees to worry about. There is a $10 inactivity fee for the debit card if it’s not used once every 90 days, so as long as you’re meeting the debit requirements this won’t come into play, but if you let the account go dormant you’ll get hit with the fee. There is also a $5.95 monthly fee if you sign up for Bill Payments but don’t actually use it in a month.

Our Verdict

Assuming this is a soft pull, this account is very very good. 4% rate on balances up to $15,000 is great (usually the maximum balance is much lower on accounts with that type of rate). The fact that no direct deposit is required makes it even better. It is a shame you need to open the account in branch though.

All of that being said (and assuming a soft pull) this is one of the best high interest rewards checking accounts currently available.

No luck OOS

I’m in Texas but would like to open an account. Are they yet allowing out-of-state folks to join? I am a member of the American Consumer Council which has gotten me in at other out-of-state CUs.

I just called and they said it’s only for Wyoming residents or spouses of members, so I think the OOS option is dead.

WyHy now offers mobile check deposit per email I just received.

I gave my email / telephone # to the rep I was chatting with and she said they would (hopefully) contact me if they find a way to open this up to out of state people. A few minutes later I actually got an email from them with contact info, which gives me a reason to be hopeful.

I will probably be driving through Cheyenne in a few months anyway, but it would be great if we could do this online.

Maybe you can get readers of this site added as a “select employer group”? 🙂

Been almost a year and was wondering if you were able to find out about opening an account for out of state people?

I successfully opened an account today over the phone. Sent Will a list of new information to update the post.

Good deal, was hoping to hear back from you on this.

Been a long time since I’ve opened an account on line so a couple questions if you don’t mind.

Did you have any problems opening on the phone? What kinds of questions did they ask? Do you think they are chex sensitive? Did you have to provide any documentation? How did you fund the account? Have you received your debit card? How is their online account?

Thanks

No problems at all. Rep was very friendly and helpful. Questions were standard – name, address, occupation, reason for account, etc.

Seriously doubt they are Chex sensitive. I’ve opened at least a couple dozen accounts in the past 2 years. They did use Trans Union for the hard pull, which is fine by me since not a lot of places use TU.

I had to use DocuSign to sign their account opening paperwork, then send a copy of my drivers license via email, along with proof that I had joined a qualifying organization.

They set the account up and I will fund with ACH, but you can mail in a check if you want. There will be a hold on funds if you mail a check. Once my trial deposits are done I’ll move funds in.

Don’t have the debit card yet, should get this week. Online account is pretty basic. The backend is run by NetTeller like another credit union account I have. I don’t think they have ACH ability, so you’ll need to push/pull from outside accounts to move funds around.

You also get the 4% interest rate the first month without having to meet the requirements, which gives you time to get things set up.

Sounds good.

Did you get any sense of whether there is a minimum $ amount for the debit purchases?

What qualifying organization did you join?

I specifically asked about debits – no minimum according to rep. I joined the Cheyenne Ski Club for $25, but found out when I called I could have joined the local animal shelter for $10.

That’s great. I saw the Cheyenne animal shelter so would go for that.

What about the 12 debit card uses. They say PIN or signature based, do you think online use to pay bills, Amazon refills or make purchases would also count?

Amazon works for my other accounts, should work here. I won’t know for sure until next month though.

I went ahead and messaged them to see if I could get some clarification about debit card usage and a couple other questions, here’s what the response was on the debit card usage:

“The 12 debit charges do not include online purchase. The purchase must be in person debit card purchase at a point-of-sale”.

“There is not a minimum dollar amount on the debit card purchases, however per our membership agreement we can close this checking if we believe the sole purpose of the activity is to qualify for the rewards, such as all 12 debit charges are for $1. The intent behind this checking is for our member to use it as their primary checking in order to justify paying the 4% interest”.

Have to think about this one, I just don’t have many needs in which I use a debit card if I can’t use it online to pay bills and online purchases.

You can buy a drink at McDonalds for $1 every day, or use the self checkout at the grocery store and buy one item at a time. That’s what I do with the Amex Everyday card to get the 30 purchases needed for the bonus.

That’s true though wonder how they’ll look at those purchases given their second answer about using it as a primary checking?

Guess one just has to try and see which way they’ll go. Will be interested in seeing your comments as you start using your card.

My May statement just closed and my 50 cent Amazon reloads worked just fine for the debit qualification. 😀

Did they post as POS withdrawals or Debit card withdrawals?

Is there any way to see if you have already met the DC requirement for the month?

The dividend rate still shows 0.00%

They posted as:

Debit Card Withdrawal: Debit Card Amazon.com AMZN.COM/BILL WA (then the date and a bunch of numbers).

The only place I see the dividend rate is when the interest posts. Mine says “Dividend Deposit: Split Rate Annual Percentage Yield Earned 3.99% from 06/01/18 through 06/30/18”

Are you doing the ACH transfer or direct deposit each month?

I did both ACH and DD.

My DC purchases at grocery store (Walmart) posted as “POS Withdrawal”, not DC Withdrawal.

If I click on the Account Info tab, it shows 0.00% dividend rate.

Could you please check your account info tab for dividend rate after you make 12 Amazon reloads?

My debits posted yesterday or today. Account info tab shows rate at 0%. Maybe it changes at the end of the month.

I’ve done Amazon debits and an ACH transfer for the 4% rate for the past two months, so I don’t see why it would fail now.

Any update on your last comment concerning the info tab showing a rate of 0%?

I checked that tab a few times. It never showed anything but 0%, but I still got my 4% (annual) interest for the month.

I don’t think that is going to be a reliable indicator. Just have to wait and see how much interest posts.

Talked to a rep via chat. To open an account, you need:

– to be a resident of Wyoming

– to have a family member that has an account there

– to work for a “select employer”, list here: https://www.wyhy.org/About-Us/Select-Employee-Groups.aspx

The rep said they had lots of interest from people outside the state and are looking at ways to let them join, but it sounds like just driving through isn’t going to work.

That’s interesting, as I was told that I could join the Cheyenne Ski Club for $5 even though I live in CO.

Maybe because you live in a connecting state? I’m a few states away, so maybe that’s why I wasn’t given that option.

For $5, I’d take it!

You were told by a rep or via online opening?

A rep that has been emailing me. Also he said it is a hard pull to open the account. Might be worth it if it’s for TU, otherwise I’m out.

Thanks, if you open it let me know.

My rep confirmed they use TU.

Sent them an email, I’ll report back when I hear form them.

They said I could open an account in CO if I join 1 of 3 groups with the cheapest being $5 for a ski group. I’ve asked a few additional questions and will report back.

When does a hard pull NOT impact your score? This is what they said, so if it is in fact a hard pull I won’t be doing this.

It is hard [pull], but because it isn’t for borrowing funds, it doesn’t count against their credit.

It may worth a trip to WY. I’ve heard Yellow Stone is beautiful. I wonder if you have to live in WY to open the account.

+1. I’m in Denver and Cheyenne is only a 2 hour drive for me.

If you try it, let us know. We do track this sort of stuff here: https://www.doctorofcredit.com/banks-allowdont-allow-state-checking-applications/